企业简介

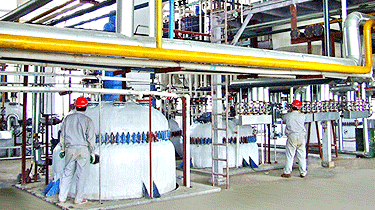

百傲化学自2003年创立,2005年投巨资在大连旅顺开发区建立生产基地;

为扩大生产能力、满足市场需求,于2009年初再次投资1.5亿元在大连松木岛化工园区置地8万平方米建厂;

主要生产异噻唑啉酮系列杀菌剂系列产品

产品应用领域

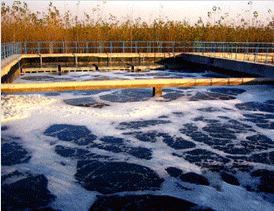

我公司的产品可广泛用于油田注水、制浆造纸、水处理、金属切割液、塑料、海洋油漆、木材、塑胶皮革、油漆涂料、化妆品、个人护理品、纺织品、纤维、地毯、建材等领域的杀菌和防腐、防霉

尤其在石油化工、电力冶金等工业领域的循环冷却水杀菌灭藻、阻垢缓蚀应用中得到了广泛的认可

营销网络

目前产品销售全国各地,并远销欧美、东南亚等地区,赢得了顾客的好评